What is a Form E in Pakistan?

Form E or E Form is an export declaration form which is used for export purpose, in it we declared that this shipment is being processed against the foreign exchange. Form E is issued by the Bank directly to the exporter which is in sets of four copies each (original, duplicate, triplicate, and quadruplicate). The shipper can get Form E from his dealing bank along with following supporting documents.

(Note: This Manual Form-E Will Only Valid For One Customs System in Pakistan, And In WeBoc Electronic Form-E Will Use For The Export Purpose, See here procedure to get Electronic Form-E for WeBoc )

Supportive Documents to Get Bill of Lading:-

1. NOC: When the shipment is being exported against 100% payment in advance so bank issue No Objection Certificate (NOC) to the shipper to shipped the shipment directly to the buyer.

2. CNF Certificate: Bank issue CNF certificate when the shipment`s terms of sale will be CNF

3. B/L Issuing Authority Letter: This certificate will be issued when the export consignment moved by sea. In case of by Air export shipment; the bank doesn’t issue this certificate.

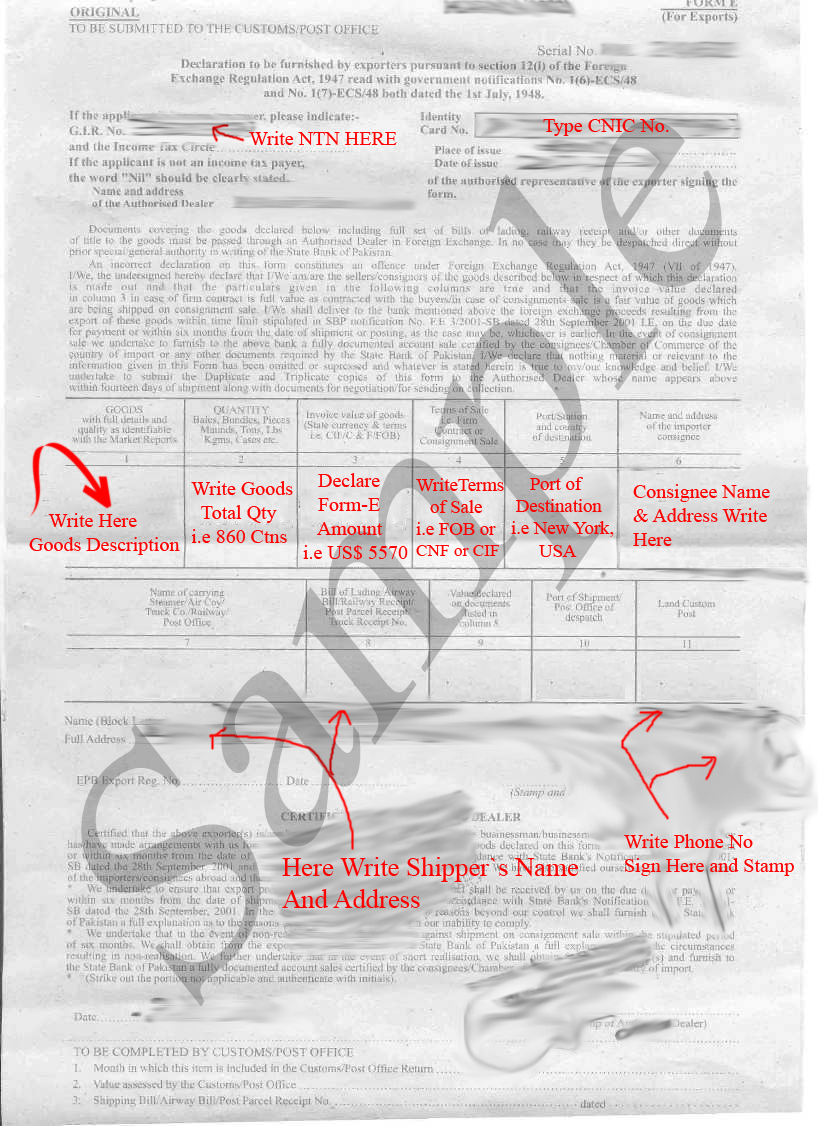

How to Fill Export Form E Correctly

Bank issued four sets of blank Form E (Original Form-E, Duplicate Form-E, Triplicate Form-E, and Quadruplicate Form-E) to the shipper. The exporter should submit the full set of Form-E to the bank after it has been completed and signed by the exporter himself or his authorized agent.

Here we see how to fill blank Form-E

1. G.I.R or NTN No:

Write here complete NTN number with a check digit. For Example, 1042578-5 if you don`t know what is NTN check digit and how to find it so visit our NTN check digit page

2. Identity Card No:

We write here CNIC number of the exporter (Company`s Owner) along with the place of issue and date of issue. Here the place of issue refers to places from where we got CNIC i.e Karachi, Lahore, Islamabad, etc.. and date of issue is a date when CNIC issued to us.

3. Goods Description (Column 1):

Here in this column, we type a complete description of exported goods. Let suppose we want to export garments so we will write Men`s 100% Cotton T-Shirts or Simply Write ReadyMade Garments.

4. Quantity (Column 2):

Write the actual quantity of export goods, the quantity can be in Kgs, Cartons, Bales, Matric Tons, Pieces (PCs), Bundles, etc.

5. Invoice Value of Goods (Column 3):

Shipment`s actual amount writes here in this column along with currency symbol and shipping term (terms of delivery) FOB, CNF and CIF. For Example US$ 145017 FOB

6. Terms of Sale (Column 4):

Here write terms of sales, according to your contract, i.e. CAD (Cash on Delivery), DA (Documents against Acceptance), DP (Documents against Payment), LC (Letter of Credit), etc..

7. Port of Shipment (Column 5):

Write your destination port where you want to ship your cargo, i.e. New York, USA

8. Consignee Name & Address (Column 6):

Write the complete name and address of consignee (Buyer).

9. Name of Carrying Shipment (Column 7):

Write the Source of shipment (i.e. By Sea, By Train, By Air, etc..) in this column if the shipment will move through the vessel (Ship) so write here By Sea in the same manner if the shipment will move by plane so we will write here By Air.

10. Name in Block Letters:

Here we write exporter name.

11. Full Address:

Here we write the exporter address.

12. Phone No:

Exporter`s Phone Number.

13. Date:

Write the date when you will verify your Form.E with Bank.

Form E Sample

Form-E Correction:-

While filling Form-E try not to do any mistake, if you mistakenly write something so don`t overwrite just cut that word and again write next to it, but remember you will have to inform your bank about this correction and bank will place around stamp (Correction Stamp) on it, without bank`s round stamp correction will not be considered as a valid correction.

Related Posts:

- Kict Vessel Schedule

- Online Sim Verification

- The Anti-Narcotics Force (ANF)

- Items Banned for Exports In Pakistan.

- List of Certificate Required As Per Import Policy Order