Do you know How Import Customs Duty Calculate In Pakistan? If not so keep reading this post, here we learn how customs calculate duty and also give examples of customs duty calculation along with other taxes i.e. sales tax, income tax, cess etc. (List of Import Duty & Taxes In Pakistan On Imported Goods)

Customs Duty Calculation In Pakistan

Import duty calculation manually is the quite complicated process for the new trader in Pakistan but we try to make this calculation process simple & easy, following topics we will discuss in this post.

- Calculating Import Customs Value of Cargo.

- Import Customs Duty Calculation.

- Calculate Sales Tax of Imported Goods.

- How To Calculate Additional Sales Tax.

- Calculation The Income Tax Amount For Import Goods.

- How To Calculate Additional Customs Duty.

How Import Customs Duty & Other Taxes Calculate

Calculate Customs Value of Imported Goods

We have to calculate customs value first because we will need this value to find out import customs duty, sales tax, and income tax etc.

| CNF Value of Cargo | = 18389 US$ |

| Plus: Landing Charges | = 183.89 US$ (1% of CNF Value) |

| Plus: Insurance | = 183.89 US$ (1% of CNF Value) |

| Customs Value (US$) | = 18756.78 US$ |

| Exchange Rate (Rs.) | = 104.70 (Let Suppose) |

| Customs Value (Rs.) | = 1963835 (18756.78 X 104.70) |

Import Customs Duty Calculation

How to Calculate Sales Tax of Imported Goods.

| Customs Value (Rs.) | = 1963835 |

| Plus: Customs Duty (Rs.) | = 98182 |

| Plus: Additional Customs Duty (Rs.) | = 19637 |

| Total | = 2081654 |

| Sales Tax (Rs.) | = 353881 (2081654 X 17%) |

We also pay extra 3% Addition Sales Tax, due to being commercial importer

How To Calculate The Income Tax Amount For Import Goods.

| Customs Value (Rs.) | = 1963835 |

| Plus: Customs Duty (Rs.) | = 98191 |

| Plus: Additional Customs Duty (Rs.) | = 19638 |

| Plus: Sales Tax (Rs.) | = 353881 |

| Plus: Additional Sales Tax (Rs.) | = 62449 |

| Total | = 2497994 |

| Income Tax (Rs.) | = 149879 (2497762 X 6%) |

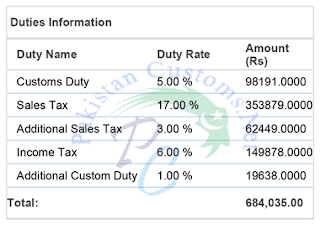

Total Customs Duty & Taxes of Import Cargo

| Customs Duty (Rs.) | = 98191 |

| Additional Customs Duty | = 19638 |

| Sales Tax (Rs.) | = 353881 |

| Additional Sales Tax (Rs.) | = 62449 |

| Income Tax (Rs.) | = 149879 |

| Total Duty & Taxes | = 684038 |

Thanks for reading this, here in this post Customs Duty Calculation In Pakistan we learned how to calculate import customs duty & other taxes manually, if you still confused or don’t understand any step discussed over here so you can contact us anytime or if you want us to calculate import customs duty of your cargo so can share your details below using comment form.

2 Comments

Hi …

I want to import a pair of birds (for Personal use, not for Commercial purpose), please guide me which documents are required to import the birds and how much duty/taxes i need to pay upon arrival of birds on air port – Lahore.

A brief guidance will be appreciated

Best Regards,

XYZ

hi

I want to know CIF value , Custom Duty / import TAX .on

Box weight 15KG , value Declared 60 USD , Shipping Cost 70USD.