Customs Import Duty on Liquid Milk, Milk Powder, Flavored Milk, and Yogurt/Buttermilk in Pakistan

In this article, we discuss, Customs Import Duty on Liquid Milk, Milk Powder, Flavored Milk, and Yogurt/Buttermilk in Pakistan and Valuation Ruling

Customs Import Duty on Liquid Milk in Pakistan (Tetra Pack)

Hs Code of Liquid Milk: 0401.5000

Customs Duty 20%

Sales Tax 17%

Additional Sales Tax 3%

Income Tax 5.5% for Filer 11% for Non-Filer

Additional Customs Duty 6%

Conditions/Required Certificate for Import in Pakistan:

- Heath Certificate issued by an Authorized Veterinary Officer of the country of export.

- Goods Have a shelf-life of more than 50%.

- Goods fit for Human Consumption, Free for Haram

IMPORT POLICY PROVISIONS

- Packaged Liquid Milk is an importable subject to meet Pakistan standards at the import stage [Sr. No. 1, Appendix-N, SRO 902(I)/2020 dated 25th September 2020].

- Every animal product imported into Pakistan shall be accompanied by a health certificate in the Form from where such animal is imported [Clause 3(2), Pakistan Animal Quarantine (import and Export of Animals and Animal Products) Rules, 1980 notified vide SRO 1007(I)/1980 dated 20th August 1980].

- Edible products are importable if fit for human consumption, have at least [66% (2/3rd) of the shelf life remaining from the date of manufacturing, and are subject to certain other conditions [Sr. No. 10, Appendix-B, Part-1, SRO 902(I)/2020 dated 25th September 2020]

Banned from India [Paragraph 5(A)(ii), SRO 902(I)/2020 dated 25th September 2020].

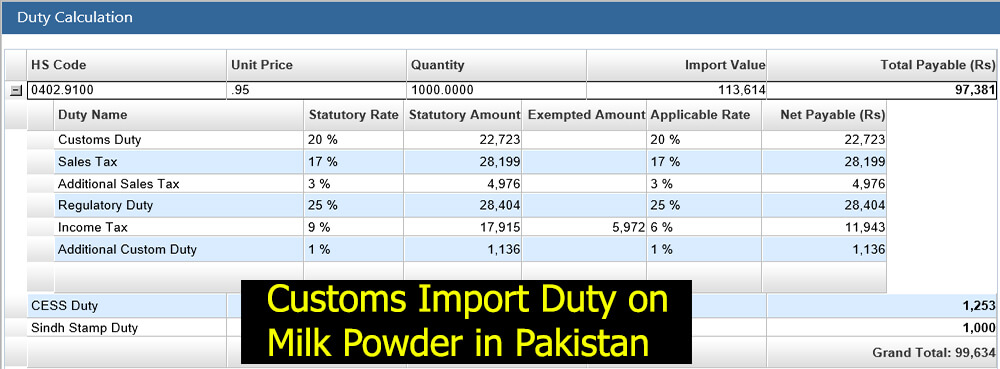

Customs Import Duty on Milk Powder in Pakistan

Hs Code of Milk Powder: 0402.9100

Customs Duty 20%

Sales Tax 17%

Additional Sales Tax 3%

Regulatory Duty 25%

Income Tax 5.5% for Filer 11% for Non-Filer

Additional Customs Duty 6%

Conditions/Required Certificate for Import in Pakistan:

1) PSQCA`s Conformity Assessment Result Certificate

Customs Import Duty on Flavored Milk in Pakistan

Hs Code of Flavored Milk: 2202.9900

Customs Duty 20%

Sales Tax 17%

Additional Sales Tax 3%

Regulatory Duty 20%

Income Tax 5.5% for Filer 11% for Non-Filer

Additional Customs Duty 6%

Conditions/Required Certificate for Import in Pakistan:

1) Heath Certificate issued by an Authorized Veterinary Officer of the country of export.

2) Goods Have a shelf-life of more than 50%.

3) Goods fit for Human Consumption, Free for Haram

Customs Import Duty on Yogurt/Buttermilk in Pakistan

Hs Code of Yogurt: 0403.1000

Customs Duty 20%

Sales Tax 17%

Additional Sales Tax 3%

Regulatory Duty 20%

Income Tax 5.5% for Filer 11% for Non-Filer

Additional Customs Duty 6%

Conditions/Required Certificate for Import in Pakistan:

1) Heath Certificate issued by an Authorized Veterinary Officer of the country of export.

2) Goods Have a shelf-life of more than 50%.

3) Goods fit for Human Consumption, Free for Haram