WeBoc E-Payments Procedure Pay Duties and Taxes Using Online Banking/ATM – How to Create Payment Through 1 Link in WeBOC

E-Payment Guideline, How to Create Payment Through 1 Link in WeBOC

1.Round-the-clock facility is being provided to importers / exporters to pay Customs Duties, taxes and other dues electronically from their bank accounts through internet banking and automated teller machines (ATM) for clearance of consignments through WeBOC system.

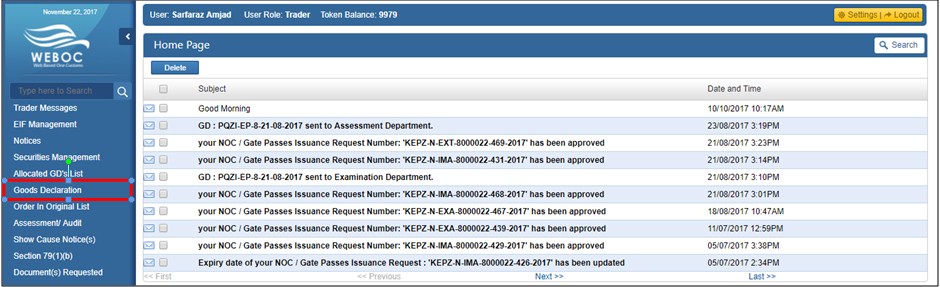

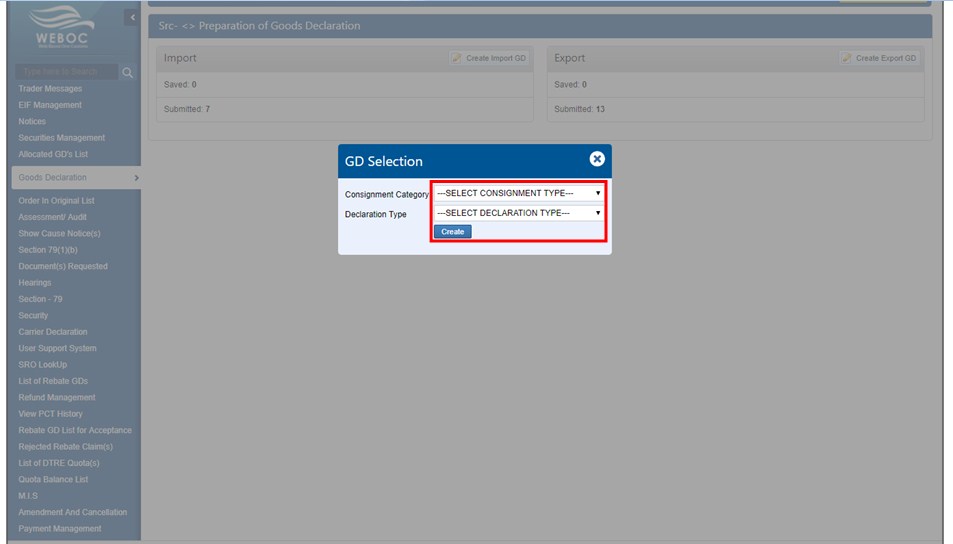

2.Trader/Clearing Agent shall login to WeBOC system for filing of Goods Declaration in WeBOC.

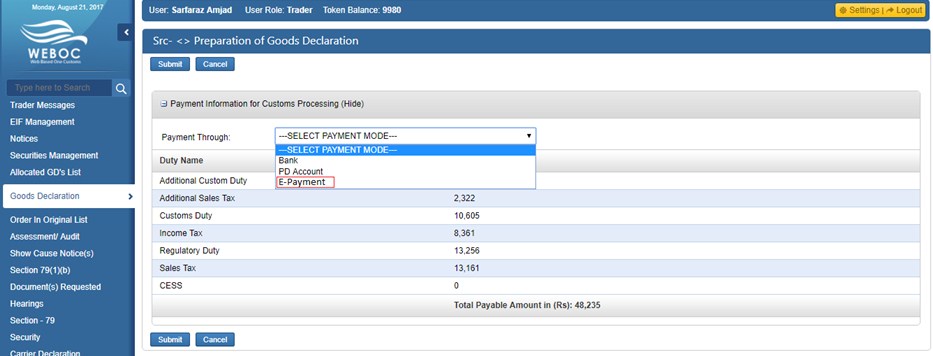

3.Trader/Clearing Agent will click on the “Submit” button of Goods Declaration. Upon click on the Submit button system will display the Goods Declaration Payment Information Screen to Trader/Clearing Agent.

4.In the drop down menu for Payment Mode, the Trader/Clearing Agent shall select the Payment Mode of “E-Payment” and click on the “Submit” button. Upon click on the submit button, WeBOC system will submit the GD successfully and display the link “Pay duty and taxes via 1Link”.

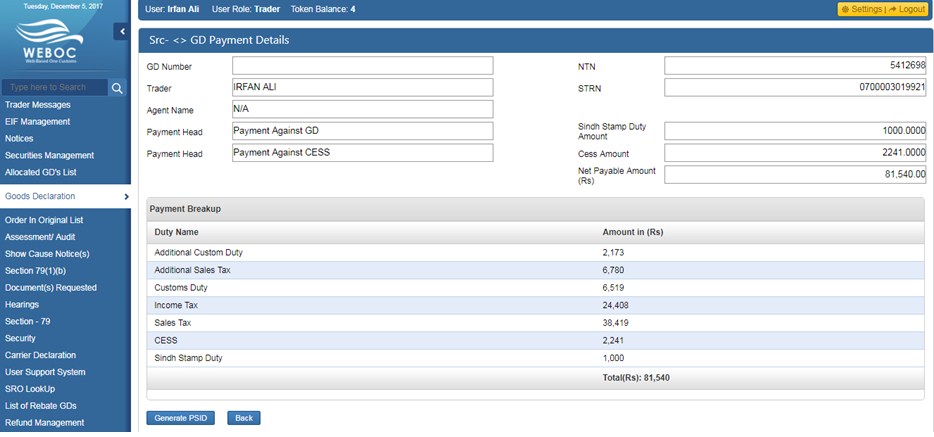

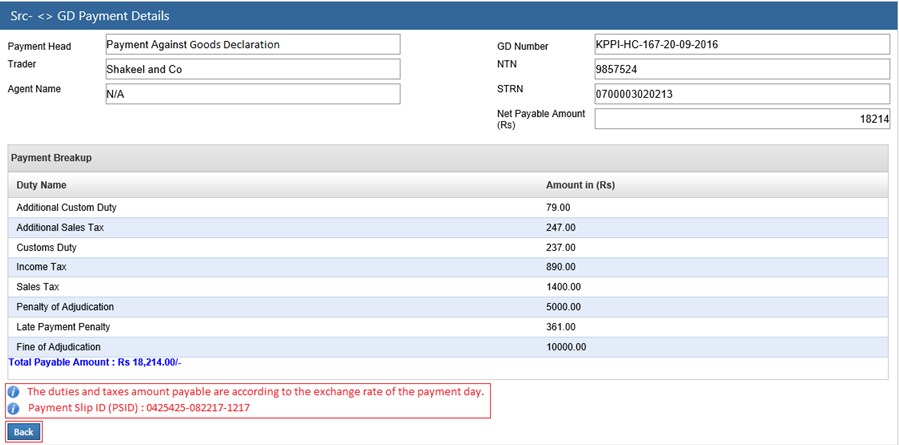

5.Trader/Clearing Agent will click on the above link and WeBOC system will generate a unique 20 digit Payment Slip ID (PSID). The system will display the duty and taxes breakup along with PSID.

6.The trader shall login to the online banking system of his bank through computer or mobile phone or visit ATM facility. The bill payment screen of the bank shall reflect “FBR” as biller. The trader shall click the option “FBR”. The bank / ATM screen shall require the trader to enter PSID generated by WeBOC system.

7.By entering PSID, the payment details shall be visible to the trader for approval of the payment of duty & taxes. Upon confirmation, the bank account of trader shall be debited and a message of successful transaction shall be visible on the screen.

8.WeBOC system will accordingly process the Goods Declaration filed by the trader.

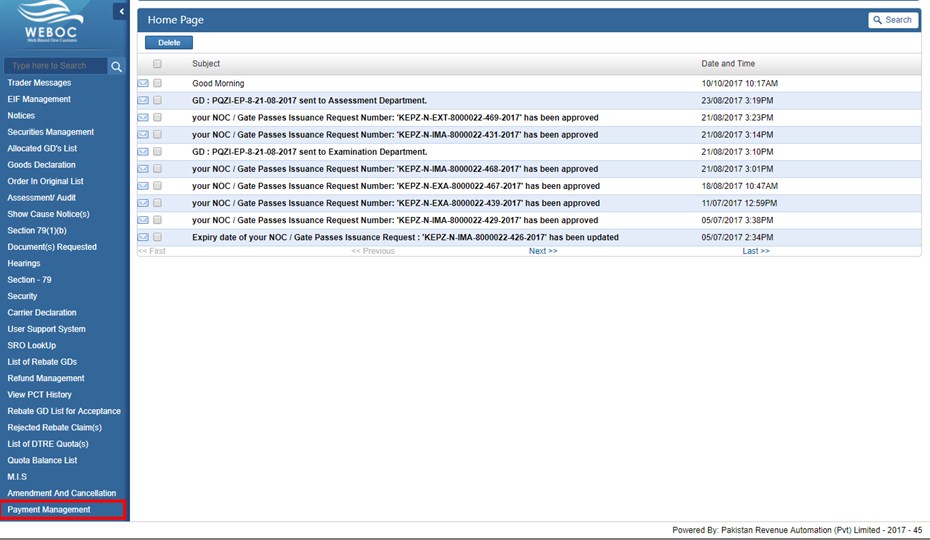

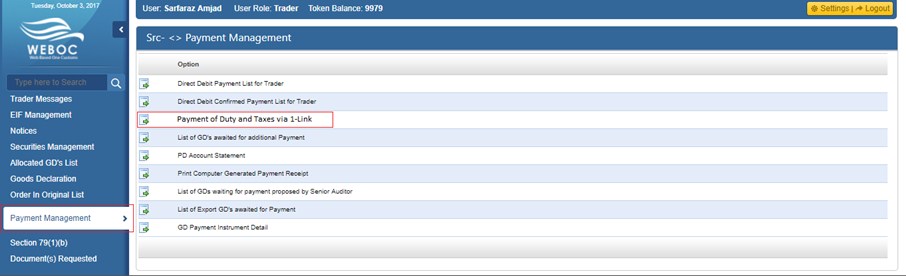

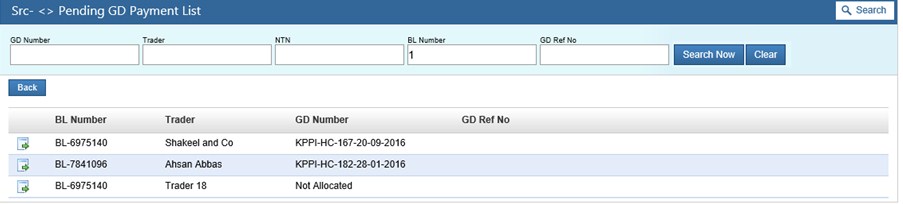

9.For any subsequent payment of dues in relation to the processing of Goods Declaration as a result of any reassessment made by Customs, the trader shall click “Payment Management” from his WeBOC home screen and click the link “Pay duty and taxes via 1Link”. A sub menu “Payment against GD” shall be opened. Upon clicking the same, a new screen shall appear in which option will be available to search GD against which payment is require to be made. Upon clicking the specific GD, the system will provide “Generate PSID” option. Upon clicking the same, a new unique PSID shall be generated which can be utilized by the trader to pay duty / taxes in the same manner.

10.On the basis of unique transaction ID issued by the SBP/BSC, WeBOC will issue e-CPR to importer / tax payer through WeBOC System.

11.Screen shots are given below for ease of reference.

1. Create Payment Slip ID (PSID) for E-Payment while Goods Declaration

2. Create Payment Slip ID (PSID) for E-Payment from Payment Management

WeBoc E-Payments Procedure Frequently Asked Questions (FAQS)

1.What is E-Payment?

It is the round-the-clock facility provided to importers / exporters and their authorized Customs agents to pay Customs Duties, taxes and other dues electronically from his bank account through internet banking, automated teller machines (ATM), bank’s mobile applications for clearance of consignment through WeBOC system.

2.What is PSID?

Payment Slip ID (PSID) is a 20-digit number unique number generated by WeBOC system for making payment of dues by the trader through internet banking, automated teller machines (ATM), bank’s mobile applications.

3.When is a PSID generated?

Every time a payment is created against a particular GD after selecting e-Payment option, a PSID number will be generated. For every payment event (initial payment at the time of filing of GD and subsequent payment as a result of any reassessment) WeBOC system will generate a separate unique PSID.

4.Would there be an option to view a PSID generated against a particular B/L or GD?

Yes. A user will be able to see the PSID generated against a particular B/L or GD in the sub-menu of ‘View Generated PSIDs for E-Payment’ in the ‘Payment Management’ tab.

5.Would there be an option to view the PSIDs against which payments have already been made?

Yes. In sub-menu ‘Print Computer Generated Payment Receipt’ of the ‘Payment Management’ tab.

6.Is there any facility to pay duty and taxes against a GD from multiple bank accounts available in e-Payment?

For a single PSID, it is mandatory to pay duty / taxes from a single bank account. However, for subsequent payment of duty / taxes for the same GD via a new PSID, payment can be made from a different bank account.

7.Is it possible to make payment of duty / taxes for a single GD through E-Payment as well as other payment modes such as pay order / cash?

For a single payment event, it is mandatory to pay duty / taxes from one payment mode. However, for subsequent payment of duty / taxes for the same GD, payment can be made from a different mode of payment.

8.What are the modes of payment available to a WeBOC user?

i. ATM ii. Bank e-payment portal iii. Bank Mobile bill payment application

9.What is the limit for payment through E-Payment mode?

There is no limit and any amount of livable duty and taxes can be paid through E-Payment via ATM or online banking or mobile application.

10.What if the trader account is debited but payment acknowledgement is not received by WeBOC system?

There is a Dispute Resolution mechanism available in e-Payment System. In such cases, the customer will first contact his bank and then the Collectorate concerned who will forward the matter to M/s. 1LINK. The trader can report such issues to WeBOC team on the following email / phone numbers: epayment.customs@pral.com.pk 021-99214237

11.What type of GD processes are covered under e-Payment?

All types of GD-related processes are covered under e-Payment.

12.In case of IGM de-blocking, the facility for payment through e-Payment is available?

Yes IGM deblocking payment can be made through E-Payment.

13.At what time exchange rate will be updated for E-Payment?

At 00:00 hours (midnight).

14.Is it advisable to pay duty and taxes through e-Payment mode between 11:30 p.m. to 12:00 midnight?

No (due to change of exchange rate there could be an issue with reconciliation of transaction).

15.What if the GD is re-opened by the user after the PSID number has been generated?

In such cases, the PSID will be cancelled. The user will again select the payment mode.

16.At the time of opting for e-Payment, what other modes-of-payment are available to the user?

i. Bank (manual payment option through NBP) ii. PD Account 17.After the launch of e-Payment, would the option for payment through PD Account remain available?

E-Payment system is different from payment through PD account. The option to pay duty / taxes through PD account shall remain available.

18.Would there be an e-CPR (Electronic Payment Receipt) generated like through PD Account?

Yes the WeBOC system shall generate e-CPR to the trader.

19.If user opts for e-payment, would the option for manual be still open?Yes, even after generation of PSID.

Related Searches:

Electronic Payment Module in WeBOC,

Procedure for duty tax payments through ATM online banking in WeBOC,

WeBoc E-Payments Procedure,

WeBoc E-Payments Pay Duties and Taxes Using Online Banking ATM,

WeBOC 1 Link Payment Procedure,

WeBOC 1 Link Payment guide,

Import Duties Payment through 1 Link,