Customs Import Duty on CCTV Cameras in Pakistan – Customs Value (Valuation Ruling) of CCTV Cameras

Customs Import Duty on CCTV Cameras in Pakistan: This article explained Customs Import Duty on Surveillance Cameras and Close Circuit TV Cameras(CCTV) Cameras in Pakistan – Customs Value (Valuation Ruling) of CCTV Cameras

HS Code of Surveillance Cameras and Close Circuit TV Cameras(CCTV) in Pakistan 8525.8010

Customs Import Duty on CCTV Cameras in Pakistan

- Customs Duty 11%

- Additional Customs Duty 2%

- Sales Tax 17%

- Additional Sales Tax 3%

- Income Tax 3% for Filer 12% for Non-Filer

Condition and Required Documents for the Import of Close Circuit TV Cameras(CCTV) in Pakistan

- As per Appendix B Part, I Serial 68, Surveillance Cameras and Close Circuit TV Cameras(CCTV) is importable subject to the production of Security Agency License and importable by the public and private sector agencies for installation at workship places.

- As per Appendix B Part I Serial 58, on the import of Close circuit TV cameras, NOC from the Pakistan Electric Media Regulatory Authority(PEMRA) is Required.

- Not importable in Secondhand and Used Condition.

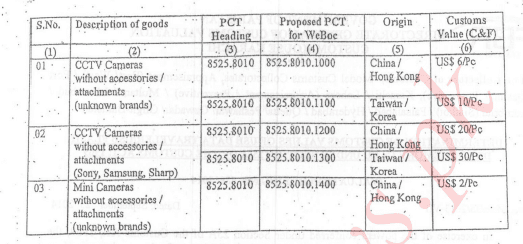

Valuation Ruling on CCTV Cameras in Pakistan

Customs Values of CCTV Cameras (Valuation Ruling No.621/2013)

Download Valuation Ruling on CCTV Cameras in Pakistan

How to Calculate Customs Duties and Taxes with Simple Calculator – How to Calculate Import Charges

Below topics will also discuss soon:

- import CCTV cameras from china,

- custom duty on CCTV camera,

- custom duty on electronic goods in Pakistan,

- Surveillance Cameras import customs duty,

- Closed Circuit TV Cameras import customs duty,

- Surveillance Cameras import customs duty,

- Close Circuit TV Cameras customs value,

- Surveillance Cameras customs value,

- Close Circuit TV Cameras import customs duty,