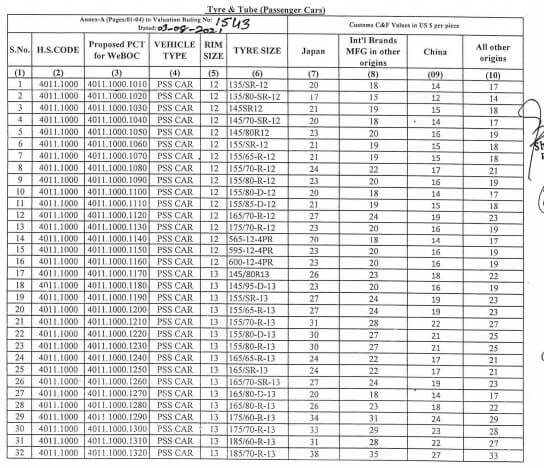

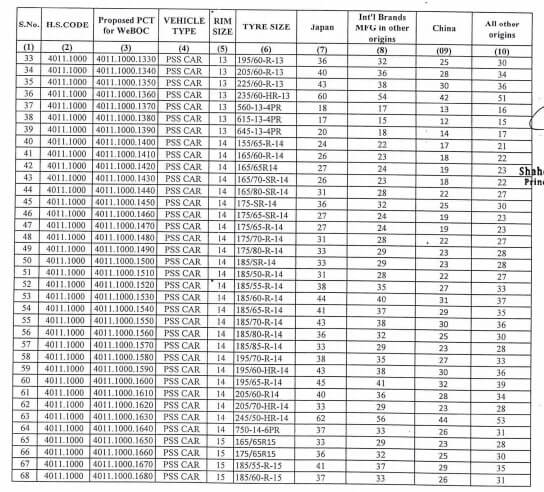

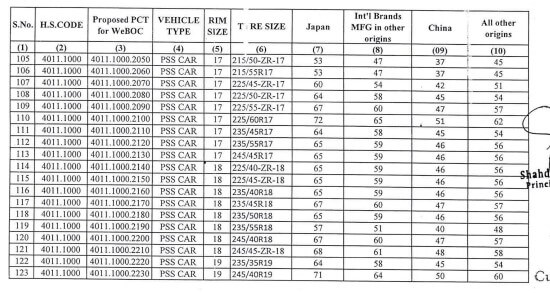

Valuation Ruling 1543/2021

In Valuation Ruling 1543/2021, Customs Values of Passenger Cars Tyres & Tubes under Section 25-A of the Customs Act, 1969.

Customs Values of Passenger Cars Tyres & Tubes

- Customs values for Tyres and Tubes-I (Passenger Cars)- hereinafter specified, shall be assessed to duty / taxes on the Customs Values as mentioned at Annexure-A, which form integral part of this Valuation Ruling along with following conditions:

- If a radial tyre is imported which is not covered in this Ruling and whose specifications are similar to normal tyre except for being radial, such tyres may be assessed at 12% higher value than that of the normal tyre.

- Values of the tyres with different “ply” shall be assessed by adding or subtracting from the determined value @ 3% per two ply rating.

- Discount of 5% is admissible for import of tyres and tubes through land route on C&F value determined by this Directorate General.

- If tyres and tubes having specifications other than those mentioned in the valuation ruling are imported, the Collectorates may assess the goods under Section 25-A of the Customs Act, 1969 or may refer a case to this Directorate General for suitable advice

Description of goods:

Tyre & Tube (Passenger Cars)

HS Code of Passenger Cars Tyres & Tubes:

4011.1000

Vehicle Type:

PSS CAR

RIM Size:

12, 13, 14, 15, 16, 17, 18, 19