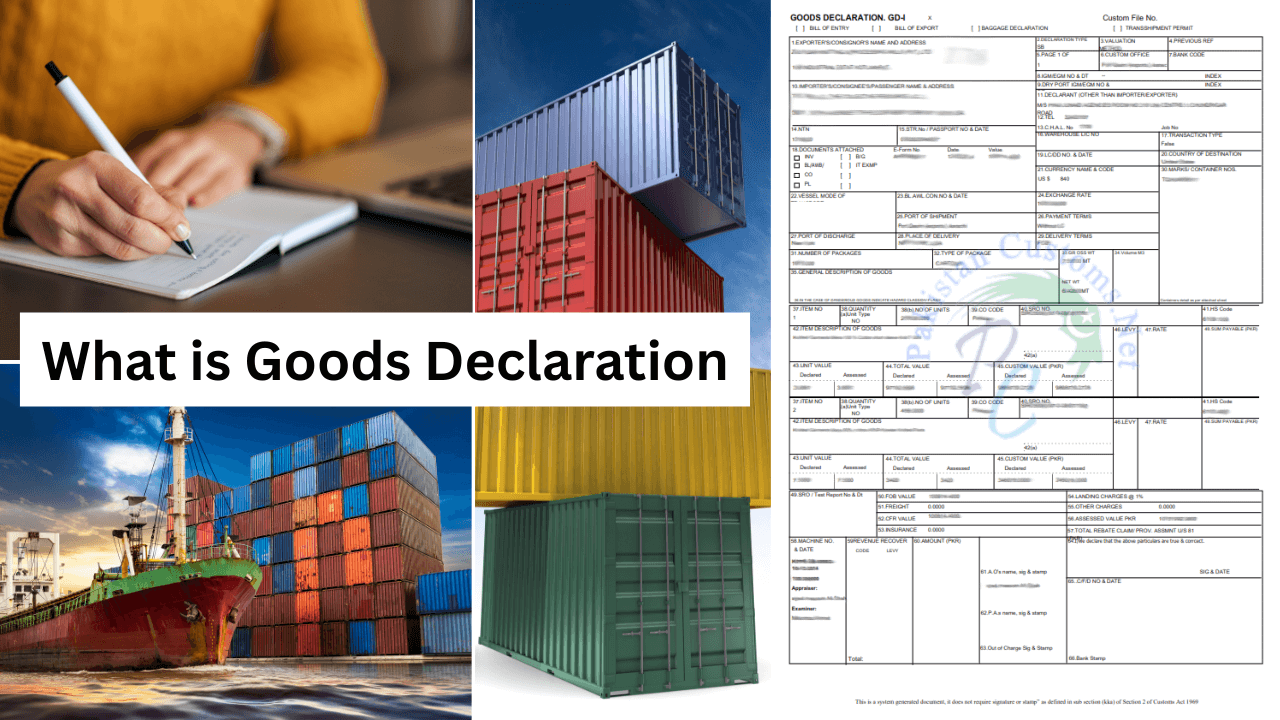

What is Goods Declaration?

Goods Declaration is a significant legal document that is submitted to the Pakistan Customs and includes elaborate details about exported or imported goods. Be it an incoming shipment to Pakistan or an outgoing one, this declaration is essential in the Customs Clearance Process.

Learning the Purpose of Goods Declaration

A Goods Declaration is a formal application to the customs department requesting them to clear goods. This document holds all the required data like HS Code Pakistan, description of the item, quantity, value, origin country, and destination country. It provides assurance that the right customs tariff will be used and duties and taxes will be correctly calculated.

For an Import Goods Declaration, the importer is required to provide information via the PSW System, Pakistan’s electronic customs clearance system. The provided information assists the customs officials in checking if the import complies with the law of trade and tariff.

Why Goods Declaration Matters?

Each Importer of Record should realize the importance of this step. Without a duly filed Customs Declaration Form, goods can be unnecessarily delayed or even subjected to penalties. An Export Goods Declaration, in turn, for exports, ensures the shipment complies with the local and international documentation rules.

Principal documents accompanying a Goods Declaration would be:

- Invoice & packing list

- Bill of lading

- Importer/exporter’s CNIC and NTN

- Certificate of origin

- Any license or permit necessary

- Delivery Order (DO) from Shipping Company

These documents contribute to the validation of the transaction and substantiate the information presented in the GD.

Goods Declaration in Pakistan

In the case of Pakistan, the GD needs to be filed online using the PSW System, employing structured fields referred to as GD 66 columns. Each column identifies specific details about the consignment, ranging from product codes to modes of shipment.

How Many Columns Are There in GD?

A full GD form in PSW contains 66 detailed columns, ranging from exporter/importer details to shipment value, taxes, and shipping mode. Some of the important fields are:

GD (Good Declaration) consist of 66 column which are given below:-

GD – 66 column Details With Explanation

1) EXPORTER / CONSIGNOR

Fill in the exporter’s full name and address — the party or entity that is selling merchandise to the foreign buyer.

2) DECLARATION TYPE

A two-digit code from the Customs Procedure Code (CPC) representing the customs regime applicable to the merchandise. The following options are available: import, export, temporary import, bonded warehouse, transit, re-export, re-import, duty-free shop, or free zone. (For more details on the codes, refer to Annex 2.)

3) VALUATION METHOD

Enter the code for the method of valuation used to make the declaration of the value of the goods under Section 25 of the Customs Act, 1969. (See Annex 3.)

4) PREVIOUS REF.

Use this space to indicate any prior reference to the shipment, especially in situations such as temporary import/export or part shipment. Enter the previous GD number.

5) PAGE 1 of — PAGES

State the number of GD pages, including the principal form and any continuation pages (Form GD–II).

6) CUSTOMS OFFICE

Insert the code of the concerned customs office (e.g., Port Qasim – Exports, MCC Export, AFU Export – Airport, MCC Export Karachi – PICT, KICT).

7) BANK CODE

State the bank and branch code by which the transaction is or will be settled. (Not applicable in PSW.)

8) IGM / EGM NO. AND DATE

Enter the Import General Manifest (IGM) or Export General Manifest (EGM) number and date, if known at the time of lodging the GD.

9) DRY PORT IGM / EGM NO. AND DATE

Complete if the goods are being processed through a dry port facility.

10) IMPORTER / CONSIGNEE

Enter full name and address of the consignee — the individual or business the goods are going to.

11) DECLARANT (OTHER THAN EXPORTER / IMPORTER)

Input the declarant’s name and address or the individual filing the GD, if self-declared, as “Self.”

12) TEL(S)

Provide the declarant’s contact number.

13) C.H.A.L NO. [REF]

Insert the Customs House Agent License number. Other internal references can be added in brackets.

14) NTN

State the National Tax Number provided by FBR to the trader.

15) SALES TAX NUMBER

Input the Sales Tax Registration number of the exporter.

16) WAREHOUSE – LICENSE NO.

If goods are arriving or departing from a bonded warehouse, insert the warehouse license number.

17) TRANSACTION TYPE

State whether the transaction is between related (“R”) or unrelated (“U”) parties.

18) DOCUMENTS ATTACHED

Code attached documents with the corresponding code from Annex 5. Also, add the E-Form number and date for exports.

19) LC / DD NUMBER AND DATE

Insert the Letter of Credit or Demand Draft number and date of issue.

20) COUNTRY OF DESTINATION

Insert the numerical country code of destination. (Refer to Annex 6.)

21) CURRENCY NAME & CODE

Insert the name of invoice currency and its alphanumeric code (e.g., USD – 840). (Refer to Annex 6.)

22) VESSEL / MODE OF TRANSPORT

Insert the mode of transport vessel, airline, or vehicle transporting goods with the respective mode of transport code. (Refer to Annex 7.)

23) B/L, AWB, CIM, CMR CONSIGNMENT NO.

Enter the reference number of consignment (e.g., Bill of Lading, Airway Bill, Rail Receipt).

24) EXCHANGE RATE

Enter the current foreign exchange rate on the date of filing of the GD.

25) PORT / PLACE OF SHIPMENT

Enter the name of the port of origin from where goods were shipped to Pakistan.

26) PAYMENT TERMS

Enter payment terms, i.e., “L/C” (Letter of Credit) or “Without L/C.”

27) PORT OF DISCHARGE

Enter seaport, airport, or land border name through which goods are to enter Pakistan.

28) PORT / PLACE OF DELIVERY

Enter the ultimate destination of the goods within Pakistan.

29) DELIVERY TERMS

Enter the trade term utilized: FOB, CNF, or CIF.

30) MARKS & NUMBERS / CONTAINER NOS.

Enter marks and container numbers, including seal numbers for FCL shipments. Additional pages can be used where necessary.

31) NUMBER OF PACKAGES

Enter total number of packages in numerals.

32) TYPE OF PACKAGES

Specify the type by codes like CTN (Cartons), PKG (Packages), etc.

33. (a) GROSS WT KG

Enter the gross weight in metric tons (MT)

33. (b) NET WT KG

Enter the net weight in metric tons (MT)

34. VOLUME M3

Enter the measurements in cubic meters. (e.g. five cubic meters should be indicated as 05). (not applicable in PSW now)

35. GENERAL DESCRIPTION OF GOODS

Enter a general description of the goods, for goods to be declared on this GD.

e.g. Wooden furniture, Textiles, Garments, Electrical items, Machinery.

36. HAZARDOUS GOODS DATA

In the case of “Dangerous” goods, indicate Hazard Class/Div./ UN Number; Flashpoint (in Degrees Celsius)

37. ITEM NUMBER

In PSW item number automatically filled

38. QUANTITY

38 (a) Unit Type:

When we enter Hs code in PSW unit type automatically detect it – i.e. Kg, No.(Pcs)

38(b) Unit Quantity:

Indicate the quantity in numeric form.

39. C.O.

Enter the numeric code of the Country of Origin of the goods from the list . The country should be as indicated on the country of origin certificate.

40. SRO NO.

The SRO number must be entered to receive other than the normal tariff and customs procedure treatment to be applied to the goods forming a line item on the GD. If there are more than one SRO numbers to be included please use the area labeled “Free Space” on the top part of the GD or reverse of GD II ‘other’ column.

Entry of a SRO number in this box constitutes a formal declaration that the conditions of the relevant regulations pertaining to that SRO will be complied with and legally binds the person signing the declaration.

41. HS Code

Enter the complete Pakistan Custom Tariff code (Harmonized System commodity code) for the commodity included under this item in the GD. Refer the Pakistan Customs Tariff.

42. ITEM DESCRIPTION

In the case of exports of textiles/garments etc. where quotas are applicable, indicate the quota/CAT number, in the dotted box at the bottom right hand corner of this box.

If a License/Permit is required to export the item, provide the reference number and date of such document in the dotted box at the bottom right hand corner of the box.

In a multiple entry shipment if any Dangerous Cargo is included provide such information as required per instructions in 36, above.

In case of export if applicable enter the Duty Tax Remission & Exemption (DTRE) Number.

43. UNIT VALUE

Please note the “Declared “ section in this box is meant for the declarant and “Assessed” section is meant for the relevant Customs officer.

44. TOTAL VALUE

Enter the total value of the item in relevant invoice currency in Declared box. Custom officials will use the box for Assessed Unit Value.

Please note the “Declared “ section in this box is meant for the declarant and “Assessed” section is meant for the relevant Customs officer.

45. CUSTOMS VALUE

Enter the total assessable value of the item in PKR. This is the sum total of declared value in box 44 and apportioned cost of freight for the whole shipment (box 51), insurance cost (box 53), landing charges (box 54) and other charges (box 55). In other words the total value of box 45 for all items should be equal to the value shown in box 56.

Enter the FOB value

Please note the “Declared “ section in this box is meant for the declarant and “Assessed” section is meant for the relevant Customs officer.

46. LEVY

Enter the numeric codes for all levies that are applicable to the goods as per annexure 14. (e.g. for Customs Duty numeric code is 01)

47. RATE

Enter the applicable rate or percentage of duty; sales tax; excise duty; income tax; Export Development Surcharge etc.

48. SUM PAYABLE

Enter the amount payable under each duty and tax type.

49. SRO/ TEST REPORT NO.

Enter the relevant SRO number or test report number and date.

50. FOB VALUE

Enter the FOB Value (in the invoice currency shown in box 21) for the total shipment at the point of direct shipment to Pakistan. In the case of CFR [Cost and Freight –C&F], CIF or any other INCOTERM contract and if the FOB cost is not known, do not fill this box.

51. FREIGHT

If the unit prices indicated in box 43 do not include freight charges, enter the freight charged for the shipment in the invoice currency shown in box 21. [Do not attempt to fill this box if the freight charges are not known].

52 CFR VALUE

In the case of CFR (Cost and Freight –C&F), shipment, enter the CFR price in box 52 in the invoice currency shown in box 21.

53. INSURANCE

Enter the amount of insurance premium paid/payable if it has not been included in the unit prices. Enter the sum total of FOB price plus the value of freight and insurance or flat rate of 1% shall be added as the insurance charges in the absence of insurance memo.

54. Landing Charges

Enter the amount of the landing charges in PKR.

55. OTHER CHARGES

Enter the other charges.

56. ASSESSABLE VALUE

Import

Enter the sum total of FOB price plus the value of freight, insurance landing charges and any other charges. Enter the sum total in PKR.

Export

Enter the appropriate amount for any duty/rebate calculation.

57. TOTAL REBATE CLAIM/ PROV. ASSMNT U/S 81

Enter the total amount of rebate/refund to be collected under section 81 for provisional assessment.

64. NAME OF DECLARANT/ DESIGNATION, SIGNATURE & DATE

In PSW no need to declared name and designation or any signature beacuase this is a system generated document, it does not require signature or stamp” as defined in sub section (kka) of Section 2 of Customs Act 1969

58. MACH INE NO.

Once Gd submitted in PSW machine no. automatically enter in GD.

59. REVENUE RECOVERED

The Customs will CHECK/ CALCULATE the duties and taxes and insert the relevant levies codes in this box.

60. AMOUNT (PKR)

All duties, taxes, and other levies automatically calculated according to hs code and payable amount shows here.

61. A.O’s Name , Signature and Stamp

The relevant Custom Officer enters his/her name signature and stamp in this section

62. P.A.’s Name , Signature and Stamp

The relevant Custom Officer name shows here (In PSW signature and stamp not required)

63. OUT OF CHARGE, SINATURE AND STAMP:

The relevant Custom Officer name shows here (In PSW signature and stamp not required)

65. C/F/D NUMBER AND DATE

This box is to be used by the National Bank of Pakistan to enter the payment receipt number.

66. BANK STAMP

The relevant bank stamp in this section (In PSW signature and stamp not required)

4 Comments

19. LC / DD NUMBER AND DATE

Enter the Letter-of-Credit number and date or Demand Draft number and date for this transaction (which ever is applicable).

Demand Draft means which is being issued from the bank for the payment to someone

TRADE WITH A EFFICIENT SERVICE PROVIDER DCO.

In Col 19 of GD, L/C details or contract is to be given. If goods are imported when L/C has already expired, will customs is bound to clear the goods or will hold it until L/C clarification is not obtained from the Bank or State Bank ?

In column 2 of the GD. as we have seen that it is written as , TP, IT, EL, FS, HC. SO CAN ANY ONE ADVISE WHAT DOES THAT MEAN PLEASE. JUNAID AHMED.