Customs Import Duty on Electrolytic Tinplate and Tin Free Sheet in Pakistan

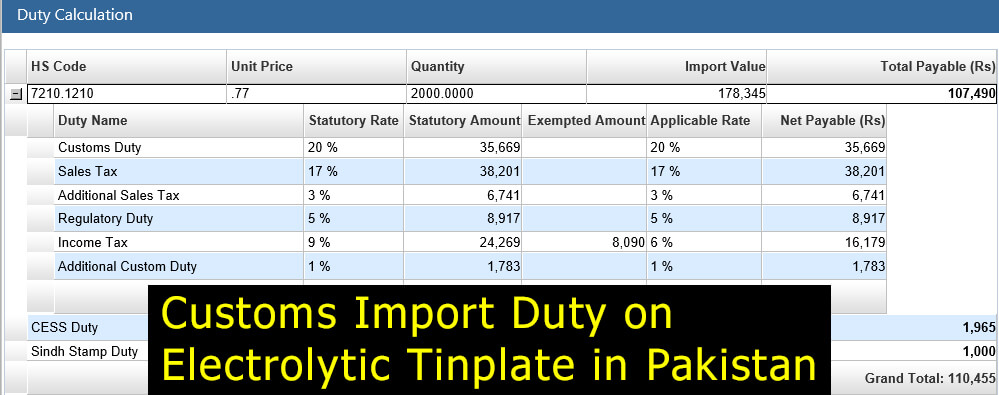

Customs Import Duty on Electrolytic Tinplate(TTP) in Pakistan

HS Code of Electrolytic Tinplate 7210.1210

Customs Duty 20%

Additional Customs Duty 1%

Sales Tax 17%

Additional Sales Tax 3%

Income Tax 6% (For Filler) or 9% (For NonFiller)

Regulatory Duty 5%

* Anti Dumping Duty is applicable if exporting Country

United States of America 11.78%

* Anti Dumping Duty is applicable if exporting Country

Germany 23.73%

* Anti Dumping Duty is applicable if exporting Country

Franch 31.31%

* Anti Dumping Duty is applicable if exporting Country

Belgium 28.62%

* Anti Dumping Duty is applicable if exporter

M/S Corus Staal BV from Neatherlands 23.96%

* Anti Dumping Duty is applicable if exporter

from neatherland other than M/S Corus Staal BV @ 39.99%

* Anti Dumping Duty is applicable if exporter

M/S MacSteel International (PVT) LTD, South Africa @ 27.33%

* Mac Steel LTD, ESCOR LTD, South Africa @ 27.33%

Tin Free Sheet(TFS) Import Duty in Pakistan

HS Code of Tin Free Sheet 7210.1290

Customs Duty 11%

Additional Customs Duty 1%

Sales Tax 17%

Additional Sales Tax 3%

Income Tax 6% (For Filler) or 9% (For NonFiller)

Regulatory Duty 5%

* Anti Dumping Duty is applicable if exporter

M/S MacSteel International (PVT) LTD, South Africa @ 27.33%

* Mac Steel LTD, ESCOR LTD, South Africa @ 27.33%

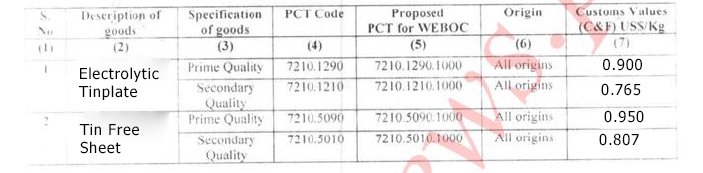

Customs Value (Valuation Ruiling No.756) for Electrolytic Tinplate and Tin Free Sheet in Pakistan

Related Searches:

Customs Import Duty On Tin Free Sheet In Pakistan,

Electrolytic Tinplate And Tin Free Steel Valuation Ruling,

Import Duty charges On Electrolytic Tinplate In Pakistan,

Import Duty charges On Tin Free Sheet In Pakistan,