Customs Import Duties on Porcelain Household Articles

Hello Doston! In this post, customs import duties on porcelain household articles are explained. We also discussed here Latest Porcelain Kitchenware Valuation Ruling No.1241/2018

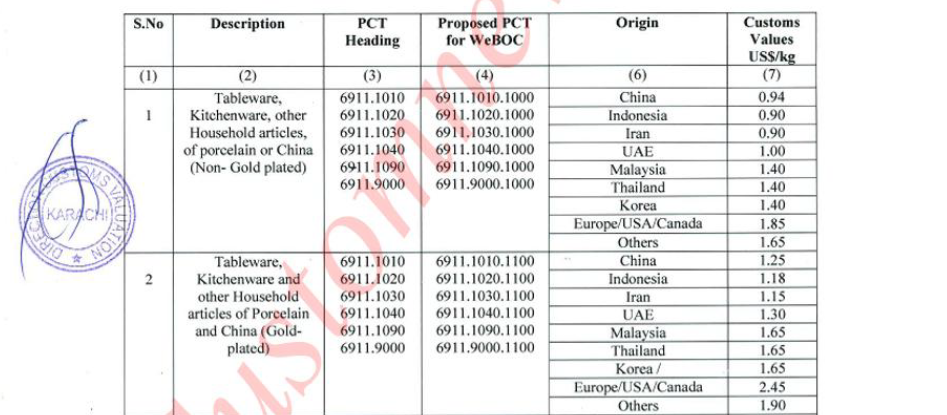

- HS Code of Porcelain Dinner sets 6911.1010

- HS Code of Porcelain Dishes 6911.1020

- HS Code of Porcelain Plates 6911.1030

- HS Code of Porcelain Teacups and saucers 6911.1040

- HS Code of Other Porcelain Products 6911.1090

Latest Customs Import Duties on Porcelain Household Articles

- Customs Duty 20%

- Additional Customs Duty 7%

- Sales Tax 17%

- Additional Sales Tax 3%

- Regulatory Duty 20%

- Income Tax 3% for Filer 12% for Non-Filer

Estimate Duty Taxes of Carbonated Beverage Filling Machine in Pakistan

Suppose we imported Porcelain Dinner Set Worth 9400 USD Weight:10,000 Kgs (Unit Price 0.94 Per KG)

- Customs Duty Rs.232564 (20%)

- Additional Customs Duty Rs.23256 (7%)

- Sales Tax Rs.320241 (17%)

- Additional Sales Tax Rs.56513 (3%)

- Regulatory Duty Rs.465129 (20%)

- Income Tax Rs.203447 (12%)

- Total Duty Taxes Rs.1301150 (Estimate)

Exemptions/ SROs for Porcelain Household Articles

SRO 640(I)/2018 2(b)

Exemption of Regulatory Duty on import under Chapter 99 of First Schedule of the Customs Act, 1969 (IV of 1969)

Porcelain Kitchenware Valuation Ruling No.1241/2018