Customs Import Duty on Second Hand/Used Clothes in Pakistan

We are going to discuss Customs Import Duty on Second Hand or Used Clothes in Pakistan, we will also share here customs value(Valuation Ruling) of Second Hand/Used Clothes.

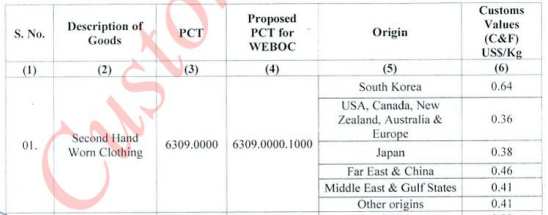

HS Code of Second Hand/Used Clothes in Pakistan

6309.0000

Customs Import Duty on Second Hand/Used Clothes in Pakistan

- Customs Duty 3%

- Additional Customs Duty 2%

- Sales Tax 17%

- Additional Sales Tax 3%

- Income Tax 6% for Filer 9% for Non-Filer

Customs Value (Valuation Ruling) of Second Hand Clothes

Customs Values of Used Clothes (Valuation Ruling No.986/2016)