Complete Procedure How To File Form I In WeBoc – How to File EIF in WeBOC

If you have a question in your mind, How to File EIF in WeBOC so you are at right place. Here we have explained complete procedure to file Import Form-I in WeBOC Step by Step.

What is EIF WeBOC?

EIF (Electronic Import Form) is a tool utilized by the government to screen the source and surges of foreign remittances and checks the merchandise that is imported in without outside trade through the State Bank of Pakistan. Assigned branches of the commercial banks are approved to issue ‘Form I’ on application by the shippers.

Electronic linkage of Custom’s Computerized System (WeBoc) with the banks for the submission & confirmation of Form “I” is an important initiative of the Pakistan Customs and State Bank of Pakistan. This initiative will help in the prevention of import related cheats and give the immediate interface among Customs and the Form “I” issuing banks.

Let`s See how importer file Form I in WeBoc System.

WeBoc system can be easily accessed through http://www.weboc.gov.pk.

After visiting above mentioned link, the browser will open the following screen asking for log-in credentials of the user.

Procedure To Create Online Form I

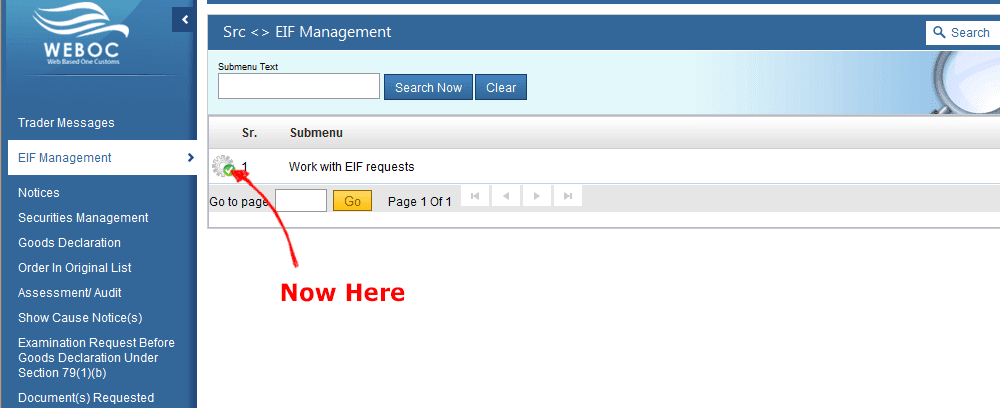

In order to add the Electronic I-Form in WeBoc click on EIF Management as indicating in below image.

Now Click on NEW EIF button so, another Form will open.

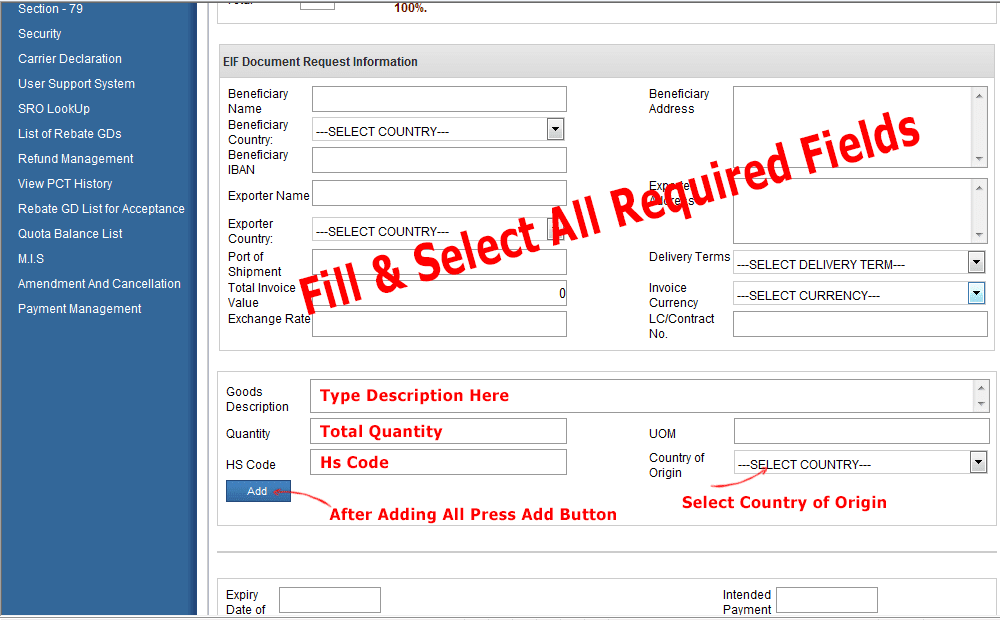

1) Select Business Name

2) Select Business Address

3) Mode of Import Payment

Followings are options of mode of payment in WeBoc

- Advance Payment

- Open Account

- Registered Contract

- Letter of Credit

Advance Payment:

1. Before GD submission BDA (Bank Debit Advice) shall be issued against any invoice value of “Form-I”

2. The total invoice value of GD cannot be greater than Form – I value or remaining values of EIF.

3. If GD is canceled then the value of GD shall not be included in next GD. Or the value of EIF of the GD canceled will be restored.

4. Declared value will always be considered to compare with EIF value.

5. If EIF is already settled then it cannot be attached with any GD

Open Account:

1. GD Can be submitted against Form-I without the issuance of BDA (Bank Debit Advice) only if the EIF value is greater than zero.

2. Only one GD can be associated with EIF

Registered Contract

1. The total invoice value of GD (Sum of total declared value of items) cannot be greater

than Form – I value or remaining values of EIF

2. If GD is canceled then the value of GD shall not be included in next GD. Or the value of EIF

of the GD canceled will be restored.

3. Declared value will always be considered to compare with EIF value.

4. If EIF is already settled then it cannot be attached with any GD

* Note: If “Contract/Collection“ selected as the mode of payment then enter Advance Payment, Document against Payment, Document against Acceptance in percent (%) which has to be 100% in Total.

Letter of Credit

1. The total invoice value of GD (Sum of total declared value of items) cannot be greater

than Form – I value or remaining values of EIF.

2. If GD is canceled then the value of GD shall not be included in next GD. Or the value of EIF

of the GD canceled will be restored.

3. Declared value will always be considered to compare with EIF value.

4. If EIF is already settled then it cannot be attached with any GD.

*Note: If “Letter of Credit” selected as the mode of payment then enter Advance Payment, Sight, Usuance in percent (%) which has to be 100% in Total.

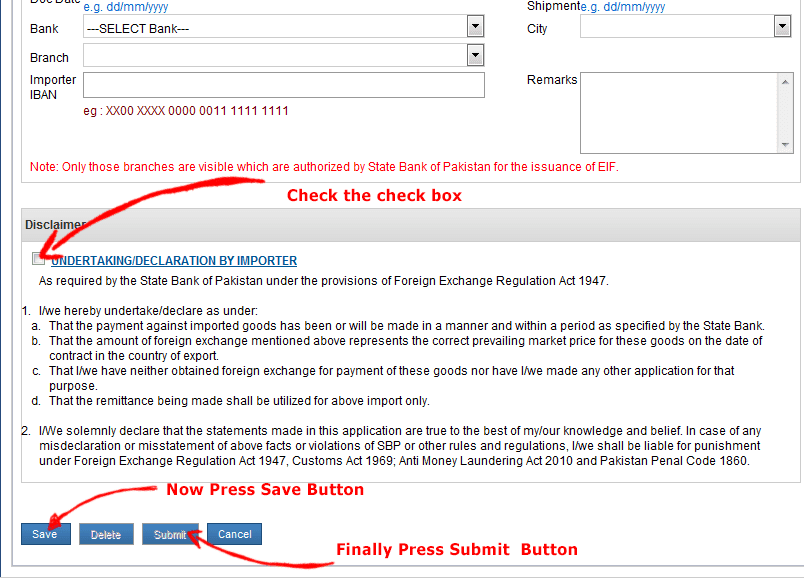

After entering all the required information press Save and then Submit, when an EIF is submitted, the Status is changed to Pending & Request sends to your bank for approval.

Once the bank accepts your request the status is changed to Approved.