Custom Import Duty on Plastic Toys in Pakistan

Here in this post, we share Custom Import Duty on Plastic Toys in Pakistan, We will get the complete details about Valuation Ruling (Customs Value) on Plastic Toys.

Hs Code Information

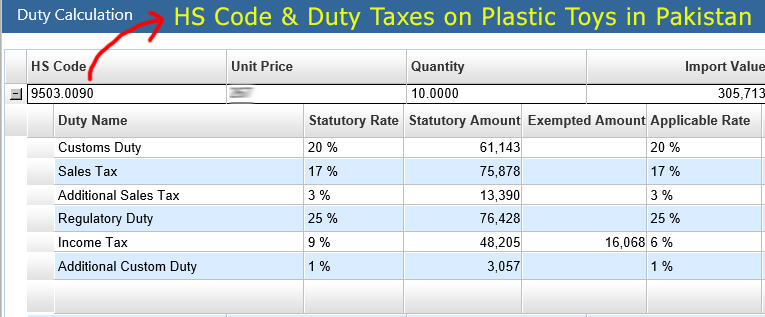

In Pakistan, 9503.0090 is used as a hs code for plastic toys.

Custom Import Duty on Plastic Toys in Pakistan

- Customs Duty 20%

- Sales Tax 17%

- Regulatory Duty 25%

- Income Tax 5.5% for Filer 11% for Non-Filer

- Additional Customs Duty 6%

IMPORT POLICY PROVISIONS

Banned from India [Paragraph 5(A)(ii), SRO 902(I)/2020 dated 25th September 2020].

Condition/Document Requirement

| Instruction |

| Please check As per Appendix B Part I -, a Certificate from the country of export that infant toys are in accordance with international standards and free from hazardous and toxic elements is required on import of “Toys for infants” |

Exemptions / SROs

| Duty | SRO | Description |

| Additional Custom Duty | 5th Schedule (Customs Duty) Part-I-39(13) | Customs Duty at 50% of the prevailing rate of customs duty on import of Zipline equipment and accessories |

| Customs Duty | 1274(I)/2006-4836 | Customs Duty @5% on import of goods-Other under SAFTA |

| Customs Duty | 1296(I)/2005-790 | Concession of Customs Duty @20% Otherunder Pak-China EHP |

| Customs Duty | 1296(I)/2005-791 | Concession of Customs Duty @12% Electric trains, including tracks, signals, and other accessories therefore under Pak-China EHP |

| Customs Duty | 1296(I)/2005-792 | Concession of Customs Duty @4% Otherunder Pak-China EHP |

| Customs Duty | 1296(I)/2005-793 | Concession of Customs Duty @4% Other construction sets and construction toys under Pak-China EHP |

| Customs Duty | 1296(I)/2005-794 | Concession of Customs Duty @4% Toy musical instruments and apparatus under Pak-China EHP |

| Customs Duty | 1296(I)/2005-795 | Concession of Customs Duty @4% Puzzlesunder Pak-China EHP |

| Customs Duty | 1296(I)/2005-796 | Concession of Customs Duty @4% Other toys, put up in sets or outfits under Pak-China EHP |

| Customs Duty | 1296(I)/2005-797 | Concession of Customs Duty @4% Other toys and models, incorporating a motor under Pak-China EHP |

| Customs Duty | 5th Schedule (Customs Duty) Part-I-39(13) | Customs Duty at 50% of the prevailing rate of customs duty on import of Zipline equipment and accessories |

| Customs Duty | SRO1151(I)/2007-126 | Exemption of Customs Duty up to the extent of 100% on import of Goods-Reduced sized model assembly kit of toy working models or not. |

| Customs Duty | SRO1151(I)/2007-127 | Exemption of Customs Duty up to the extent of 100% on import of Goods-Toys representing animals or nonhumans creatures; stuffed. |

| Customs Duty | SRO1151(I)/2007-128 | Exemption of Customs Duty up to the extent of 100% on import of Goods-Toys representing animals or nonhumans creatures – Other. |

| Customs Duty | SRO1151(I)/2007-129 | Exemption of Customs Duty up to the extent of 100% on import of Goods-Other |

| Customs Duty | SRO1261(I)/2007-5847 | Table-I Custom Duty @20%on import of goods into Pakistan from Malaysia under FTA–Dolls, whether or not dressed |

| Customs Duty | SRO1261(I)/2007-5849 | Table-I Custom Duty @5%on import of goods into Pakistan from Malaysia under FTA—Other |

| Customs Duty | SRO1261(I)/2007-5850 | Table-I Custom Duty @20%on import of goods into Pakistan from Malaysia under FTA–Electric trains, including tracks, signals, and other accessories therefor |

| Customs Duty | SRO1261(I)/2007-5852 | Table-I Custom Duty @20%on import of goods into Pakistan from Malaysia under FTA-Other |

| Customs Duty | SRO1261(I)/2007-5853 | Table-I Custom Duty @5%on import of goods into Pakistan from Malaysia under FTA-Other construction sets and constructional toys |

| Customs Duty | SRO1261(I)/2007-5855 | Table-I Custom Duty @5%on import of goods into Pakistan from Malaysia under FTA-Other |

| Customs Duty | SRO1640(I)/2019-6650 | Custom Duty @ 16 % on import of – – – OTHER |

| Customs Duty | SRO280(I)/2014-1 | Federal Government is pleased to exempt imports into Pakistan from Sri Lanka if made in conformity with the “rules of Determination of Origin of Goods under the Free Trade Agreement between the Islamic Republic of Pakistan and the Democratic Socialist Republic of Sri Lanka (Pakistan-Sri Lanka FTA Rules of Origin)” and the operating “Certification Procedures for the Rules of Origin”, notified by the Ministry of Commerce- ALL THE GOODS MENTIONED IN THE FIRST SCHEDULE TO THE SAID ACT BUT NOT SPECIFIED IN TABLES I, II & III OF SRO 280(I)/2014 |

| Customs Duty | SRO741(I)/2013-316 | Customs Duty @20% on import of goods-Other toys |

| Income Tax | Part II of First Schedule-3 | Persons importing goods classified in Part-III of the Twelfth Schedule for ATL |