Calculating import custom duty in Pakistan has been a puzzling affair for most importers, traders, and even occasional online consumers. Be it a cargo of commercial merchandise or an individual consignment, deciphering the leviable tax and duty involved has been like cracking a code. Thankfully, thanks to digital technology such as the WeBOC Customs Duty Calculator, it is now a whole lot simpler.

The assessment and collection of the customs duty in Pakistan is under the patronage of the Federal Board of Revenue (FBR). Nevertheless, manual computation of the import duty — HS Codes, duty rates, and surcharges applicable — used to require lengthy paperwork and specialist expertise. Today, one can easily calculate customs duty online based on their product details with a click or two on websites such as pakistancustoms.net and the official WeBOC portal.

The WeBOC (Web-Based One Customs) system hosted by Pakistan Customs is not only an instrument used in clearing the goods but also a critical web platform through which one can gain access to the custom duty calculator within Pakistan. Through this application, the required import duty rate that should be applicable in Pakistan is calculated automatically simply by putting the HS Code, unit value, and number of the goods into it.

Among the most popularly searched questions on this topic is “how to calculate import custom duty,” and the solution can be found by learning how to utilize these instruments efficiently. WeBOC calculator retrieves live tariff data and determines import tax in Pakistan with precise accuracy. It gives users the power to schedule their budget earlier and steer clear of additional expenditure at the time of clearance.

Even better, the user interface of this online customs duty calculator is easy to use and accessible to all — from big importers to individuals importing mobile phones or electronics for personal purposes. You don’t have to go through tariff schedules or ask agents when you can look up customs tax online in Pakistan directly using this tool.

Whether importing a car, electronics, or raw materials, the WeBOC duty calculator makes it easy and saves time. It’s a trusted solution for companies and individuals who wish to know how much is import duty in Pakistan without having to hire a customs consultant.

In the subsequent section, we’ll walk you through a step-by-step process of how to use the WeBOC customs calculator so you can be fully in charge of your import expenses with confidence and convenience.

Step by Step Guide How to Use WeBOC Duty Calculator for Import Custom Duty Pakistan

To importers, online shoppers, and customs brokers in Pakistan, it is essential to be able to calculate custom duty when importing with precision. The WeBOC Duty Calculator, which is incorporated into the Federal Board of Revenue (FBR) system, is a useful tool for calculating the precise duties and taxes on your imports. Follow this step-by-step guide to get the best out of this useful tool.

1. Access the WeBOC Website

The first step is to visit the official WeBOC website. This platform is operated by Pakistan Customs and provides a variety of services including import declarations, clearance tracking, and customs duty calculators.

To access the duty calculator, either:

- Visit WeBOC duty calculator

Tip: Bookmark the site if you frequently deal with imports in Pakistan.

2. Locate the Duty Calculator

Once you’re on the home page, scroll down to find the “Duty Calculator” link. Others may have versions of the WeBOC website where the calculator is easily found on the main home page.

The online customs duty calculator in Pakistan should normally be labeled as “Duty & Tax Calculator”

3. Click on the Duty Calculator

Clicking on the Duty Calculator link will launch a new browser window or tab. The interface typically has fields such as:

- HS Code

- Quantity

- Unit Value (USD or PKR)

- Description of Goods

This interface is intended to mimic official FBR data for custom duty calculation.

4. Input Required Information

Now input the required data as follows:

✅ HS Code

The HS Code (Harmonized System Code) is the universal international code that identifies traded products. If you are not certain of the HS Code, you can:

- Use an HS Code lookup Pakistan tool

- Check the product’s invoice or catalog

- Search “[product name] HS Code Pakistan” on Google

For example: For mobile phones, the HS code is generally 8517.1210

✅ Quantity

Input the number of units you’re importing.

✅ Unit Price

Enter the per-unit value. This should be the invoice value, usually USD.

Tip: Use only exact, declared values to prevent inaccuracies during custom clearance.

5. Import Duty Calculation

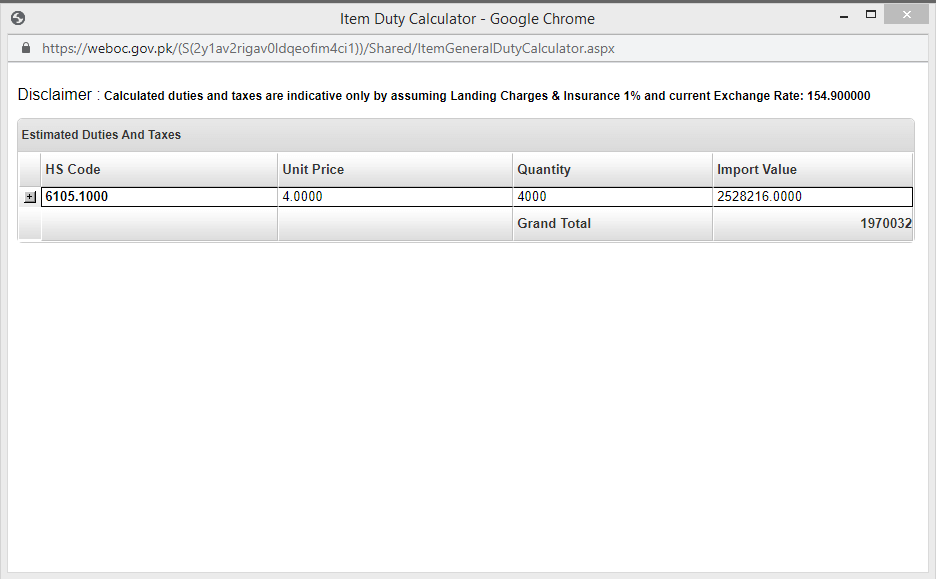

Click the “Calculate” button when all the values are filled. In a split second, the system will present an estimated aggregate of:

- Customs duty

- Sales tax

- Additional customs duty (ACD)

- Regulatory duty (RD)

- Income tax (IT)

- Any other duties leviable

The Pakistan customs duty calculator takes advantage of updated FBR tariff information, and the output is accurate for immediate planning purposes.

6. Display Detailed Duty and Tax Breakdown

To the right of the result, there is a “+” sign or an expand view option. Clicking it will give a detailed breakdown of duties, taxes, and other charges levied on your imported item.

This transparency helps users understand how customs duty in Pakistan is calculated and plan accordingly.

Example:

- Customs Duty: 11%

- Sales Tax: 17%

- Additional Duty: 2%

- Income Tax: 6%

7. Tips for Using the WeBOC Calculator Effectively

- Use Google Chrome or an updated browser for compatibility.

- Always verify HS codes through official FBR or WeBOC login databases.

- Use exact figures from shipping invoices.

- If importing from multiple countries, use separate entries for each.

8. What If HS Code Is Not Known?

You can still utilize the WeBOC platform to find HS Codes through their search feature. Enter a product name such as “laptop,” “LED light,” or “textile fabric,” and the tool will offer potential codes.

Other Ways to Find the HS Code for Your Product

Identifying the proper HS code for your product requires a series of systematic steps:

1. Online Search with Product Description

Start by performing a search online with your product description and the word “HS code.” For instance, if you’re exporting leather wallets, search for “leather wallet HS code.” This method usually produces immediate results and provides you with an initial notion of the right code.

2. Pakistan Customs Tariff

After you obtain a possible HS code, confirm it by consulting the Pakistan Customs Tariff, an exhaustive publication of all HS codes and their related duties and taxes. The tariff is available via the official website of the Pakistan Customs or through reliable websites such as pakistancustoms.net.

3. Apply the Search Function to the Tariff Document

Once you’ve opened the Pakistan Customs Tariff PDF, press “Ctrl + F” to open the search box. Type in the 4-digit HS code you’ve determined to find the specific section describing your product. This ensures that the code matches exactly your product’s specifications.

4. Cross-Verify with Product Specifications

It is important to verify that the HS code reflects your product’s material, application, and other attributes. Misclassification may result in improper duty determinations or legal issues. In case of uncertainty, refer to customs specialists or the appropriate authorities.

9. Alternative Duty Calculators

If you are experiencing problems with the WeBOC calculator, alternatives include:

- SimplyDuty.com – Excellent for quick estimates

- DHL Import Duty Calculator – Ideal for courier shipments

10. Last Words

Whatever your business import or consumer item, understanding customs tax calculation in Pakistan can shield you from unseen expenses and time wastage. Your best companion in this regard is the WeBOC duty calculator.

Simply enter your HS Code, unit price, and quantity to receive instant, clear, and comprehensive duty estimates — increasing the predictability and efficiency of importing into Pakistan.

1 Comment

Hi sir,

I want to import Palm oil CP-8 from Indonesia. I need to know customs duty and other charges per kg/Liter.

Your guidance will help me to calculate my expenses from port to my warehouse.